Ground transportation includes all forms of non-air transportation, including car rentals, taxis, personal cars, trains, and buses1.

This category also includes emergency repairs to university vehicles, tolls, and parking fees.

Cost Conscious Tips:

- With options like rideshare and public transportation available in most locations, lower cost options should be used when possible.

- Book rental cars using UC negotiated contracts.

General Guidelines

- Travelers must always choose the most economical mode of transportation.

- If travelers choose to drive when flying commercially is more economical, the lesser of the two costs will be reimbursed.

- Motorcycles are not permitted.

- Rental car agreements should be used when appropriate.

Car Rental & Required Justification

When renting a vehicle, a justification must be provided explaining why a rental vehicle was necessary instead of alternative forms of transportation (such as public transit, rideshare services, or shuttles). This justification is required for all car rental reimbursements and should clearly demonstrate the business need for the rental. Additional justification is required when upgrades are purchased.

Use the Travel Card to pay for rental cars when traveling on university business. A detailed receipt is required for reimbursement. The traveler is responsible for obtaining the best available rate commensurate with the requirements of the trip.

- Use AggieExpense to reserve rental cars.

- Use one of the UC car rental agreements whenever possible.

- Use your Travel card to pay for rental cars, especially when renting in Alaska, Hawaii, U.S. possessions (OCONUS) and foreign countries because insurance is included. If you do not have a Travel card, you may claim reimbursement for insurance costs on OCONUS and foreign rental cars.

- The traveler is responsible for obtaining the best available rate commensurate with the requirements of the trip.

Travelers may rent up to an intermediate size car.

Upgrade Process

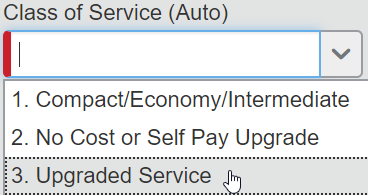

If a larger than an intermediate size vehicle is needed, at the time of travel report reconciliation in AggieExpense, and entering the car rental expense to the report:

- In the Class of Service (Auto) field, select option #3. Upgraded Service

- In the Comments field, enter a business justification for the upgraded vehicle request.

- The AggieExpense report will automatically route for exception approval.

- If the justification is missing or insufficient the expense may be non-reimbursable.

- A detailed receipt is required for reimbursement.

Mileage Reimbursement

When traveling across the Sacramento and Davis campuses to conduct business or attend meetings, travelers should first consider whether the trip is necessary. Utilize virtual options such as video conferencing when feasible. If travel is essential, travelers are expected to utilize fleet vehicles or our intra-campus shuttle services before driving their own vehicles. Mileage claims for travel between UC operated facilities in Davis and Sacramento should include a justification as to why the use of a personal vehicle was required.

- Reimbursement is based on mileage driven and the current IRS mileage rates, not actual expenses such as gasoline.

- A Personal Car must be set up in AggieExpense

- Personal insurance is required if driving your own car on UC business, see G-28 for specific limits.

- Safe Driver Awareness training is to be completed before driving on behalf of the university and renewal is required every three years. Visit the UC Learning Center to enroll and complete the online course.

- Exact addresses are required in most cases, unless unattainable or withheld due to legitimate confidentiality reasons.

- Mileage Calculation: Use an online mapping tool (e.g., Google Maps) to determine distance.

- What’s Included: The mileage rate includes fuel costs and wear-and-tear.

- Don't use your Travel Card to purchase fuel for a personal vehicle.

- Only the driver may claim reimbursement for mileage.

- For recurring trips, reimbursement claims are submitted monthly.

Please review the Remote Work Guidelines for guidance on the appropriate starting address.

Taxis, Shuttles, and Public Transportation

- Taxis, shuttles, public transportation, and ride share services (Lyft and Uber) are all allowed and encouraged.

- Reasonable tips and gratuity are permitted.

- Limousine or car service is only permitted with appropriate business justification.

- Receipts are required for any expense of $75 or more.

Parking and Tolls

- Non-UC Davis parking expenses are permitted.

- Tolls are permitted.

- Receipts are required for any expense $75 or higher.

Driving in Lieu of Flying

- If you choose to drive to a destination typically reached by air:

- Pre-approval is required.

- Submit a written explanation of your decision.

- Reimbursement will be the lesser of:

- Mileage (most direct route), or

- Cost of a coach/economy airfare booked in advance.

- To claim reimbursement for overnight lodging and meals while driving between locations, you must travel more than 300 miles per day.

- 1

If you need to charter a bus, first review the Charter Bus page.